north dakota sales tax exemption

Use exemption code 14 on the Application for Certificate of Title Registration of a Vehicle SFN 2872 North Dakota Department of Veterans Affairs - 4201 38th St S Suite 104 Fargo ND. Several examples of exemptions to the state sales tax are prescription.

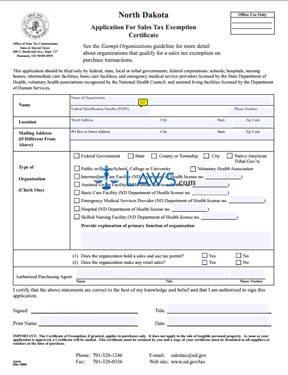

To apply for a sales tax exemption the taxpayer must submit a letter of application to the Office of State Tax Commissioner by email or mail.

. Tax permit number issued to you or your business by the North Dakota Office of State Tax Commissioner. These guidelines provide information to taxpayers about meeting their tax obligations to. No Sales Tax Exemption Available.

Hear What Our Customers Say. There are a few important things to note for both. This Kind of Customer Service is Above and Beyond.

The letter should include. The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. For other North Dakota sales tax exemption certificates go here.

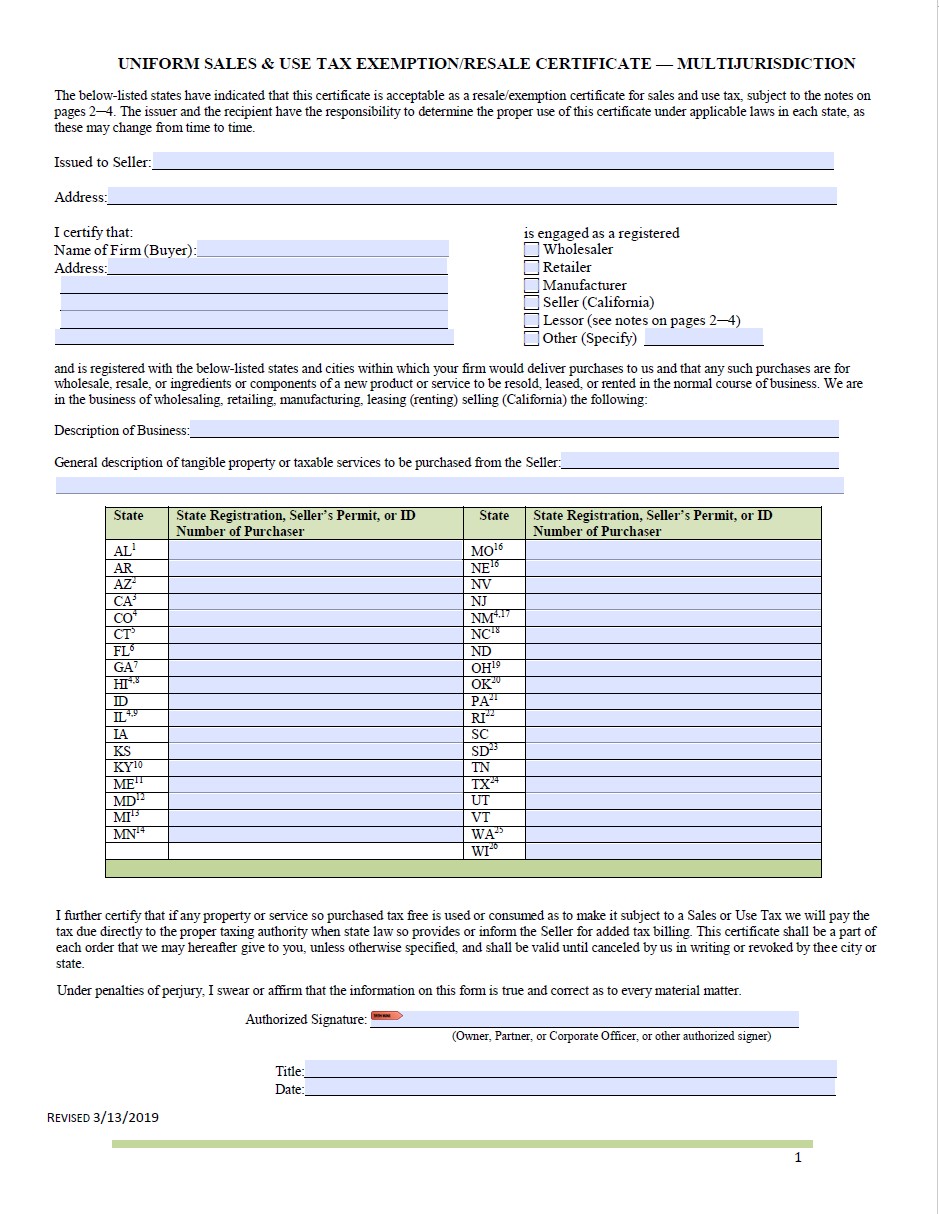

Ohio Form Example. Streamlined Sales and Use Tax Agreement - North Dakota Certifi cate of Exemption Purchaser. The gross receipts from sales of drugs that are sold under a doctors prescription for use by a person are exempt from sales tax.

How to use sales tax exemption certificates in North Dakota. 105-16413 Retail Sales and Use Tax Sales and Use Tax Bulletin see p. No Sales Tax Exemption Available.

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. The sales tax is paid by the purchaser and collected by the seller. State Sales Tax The North Dakota sales tax rate is 5 for most retail.

Learn more about different North Dakota tax types and their requirements under North Dakota law. The Community Development Loan Fund CDLF is available to businesses located in all cities and counties within the Region except the City of Bismarck for economic development. Exact tax amount may vary for different items.

If this certifi cate is not fully. Complete this certifi cate and give it to the seller. North Dakota sales tax is comprised of 2 parts.

If vehicle is less than nine 9 years old SFN 18609 Damage Disclosure Statement must be completed by. Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of. In North Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

2022 North Dakota state sales tax. The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. Ad The 1 Destination For Plumbing Heating HVAC Supplies at the Lowest Prices Online.

You can use this form to claim tax-exempt status when purchasing items. Sales Tax Exemption State information registration support. Signed by new owner with tax exemption and lienholder information if applicable.

Form 306 - Income Tax Withholding Return. Exact tax amount may vary for different items. North Carolina North Carolina GS.

Diplomatic Sales Tax Exemption Cards. Ad The Semiconductor Lifecycle Solution the worlds largest source of semiconductors. A North Dakota resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to.

Ad New State Sales Tax Registration. 14-16 NC Directive. We offer a broad product selection value added services manufacturing solutions.

North Dakota Form. Products Exempt from Sales Tax A. 2022 North Dakota state sales tax.

Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 096 for a total of. For purchases made by a North Dakota exempt entity the purchasers tax.

Wyoming Quit Claim Deed Form Quites The Deed Wyoming

Illinois Quit Claim Deed Form Quites Illinois The Deed

What Is A Tax Exemption Certificate And Does It Expire Quaderno

Taxation Of Social Security Benefits By Us State Social Security Benefits Map Social Security

What Is A Sales Tax Exemption Certificate And How Do I Get One

How To Get A Wisconsin Sales Tax Exemption Certificate Startingyourbusiness Com

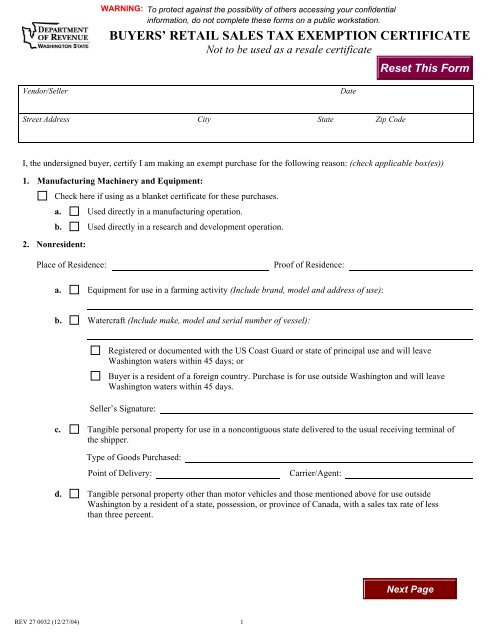

Buyers Retail Sales Tax Exemption Certificate

Form 21919 Application For Sales Tax Exemption Certificate

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

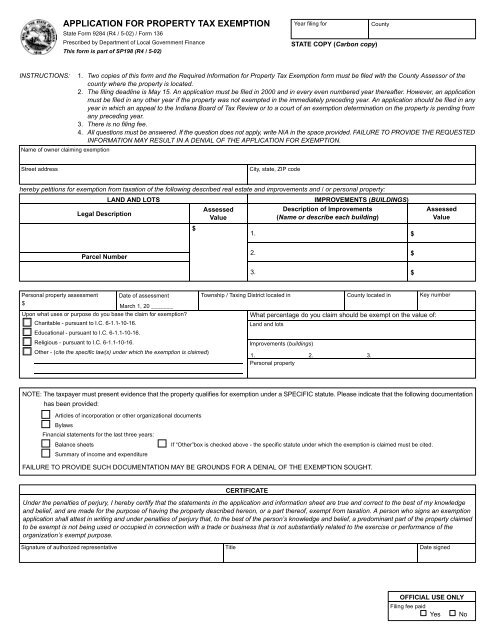

Form 136 Application For Property Tax Exemption

Arizona Student Loan Forgiveness Programs Arizona State Of Arizona Arizona State

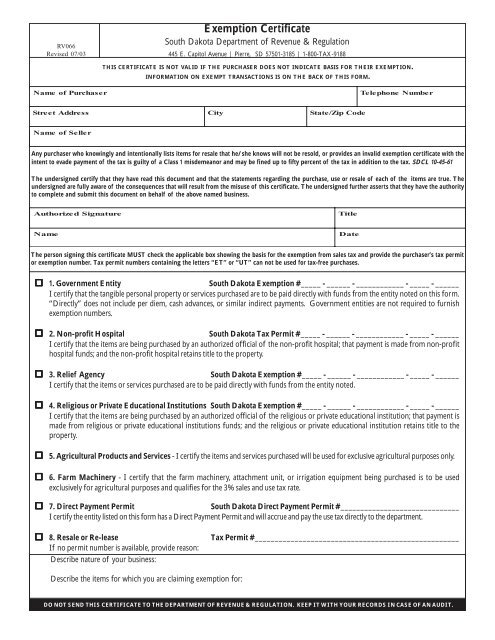

South Dakota Tax Exemption Certificate Imprints Wholesale

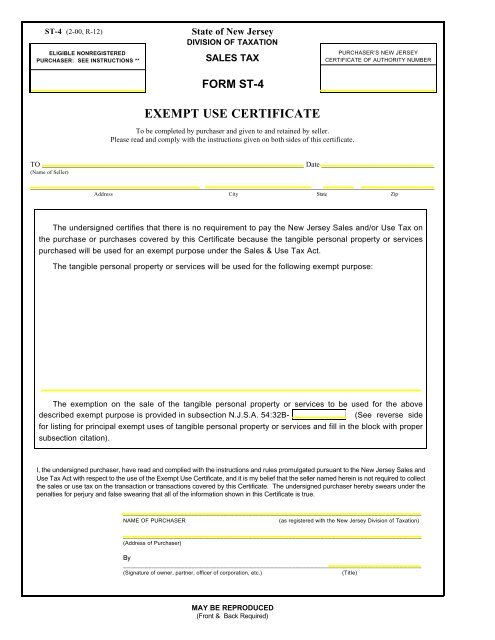

St 4 Sales Tax Exempt Use Certificate Mcnichols Company

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

Printable Washington Sales Tax Exemption Certificates

Tax Collection And Documentation Requirements For Partners And Tax Exemption